-

MarTech Maturity India Research Findings

Research Objective

To understand the evolving business dynamics for the adoption of MarTech and assess the maturity level of various companies in leveraging MarTech to provide a connected customer experience.

Research Parameters

Time period: Apr to Oct 2021

Key Industries:

• Banking, Financial Services & Insurance (BFSI) • Automobile • FMCG • Consumer Durables • E-commerce • Retail

Respondents: 100+ CXO’s and Senior Marketers from diverse industries in India

MarTech Maturity Research Findings

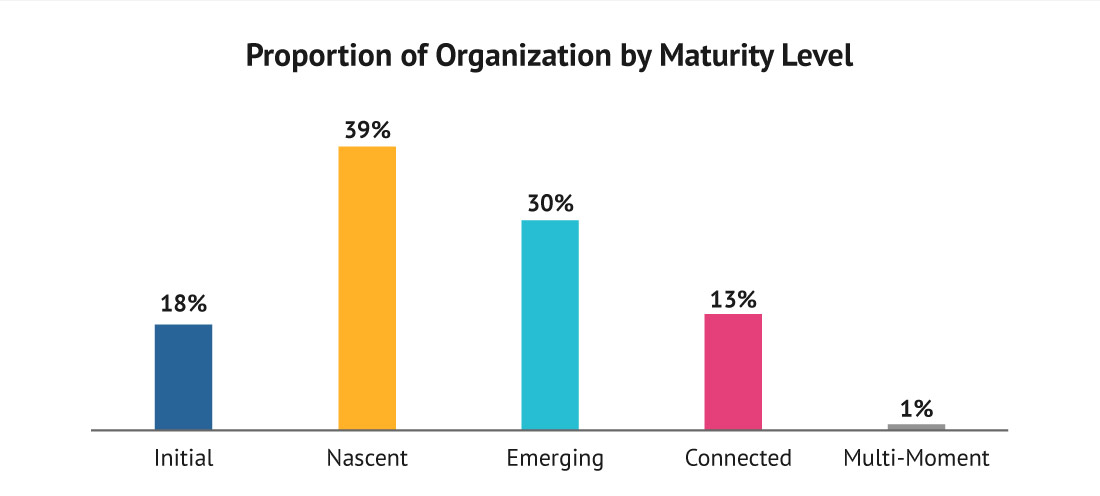

Overall MarTech Maturity

39% of the organizations were at a nascent stage in the MarTech journey, corresponding to level 2. Another 30% were at level 3, where standards were being put in place and Centre of Excellence model was typically operational. These are good indicators reflecting the fact that many organizations in India have kick started their MarTech journey. 18% were just beginning their MarTech journey with limited knowledge of this space. 13% of the organizations were at a mature level 4 stage, which represents a “connected” organization with clearly identified goals, roles & responsibilities and governance protocols to achieve improved customer engagement. This number is expected to increase across industries in the coming years.

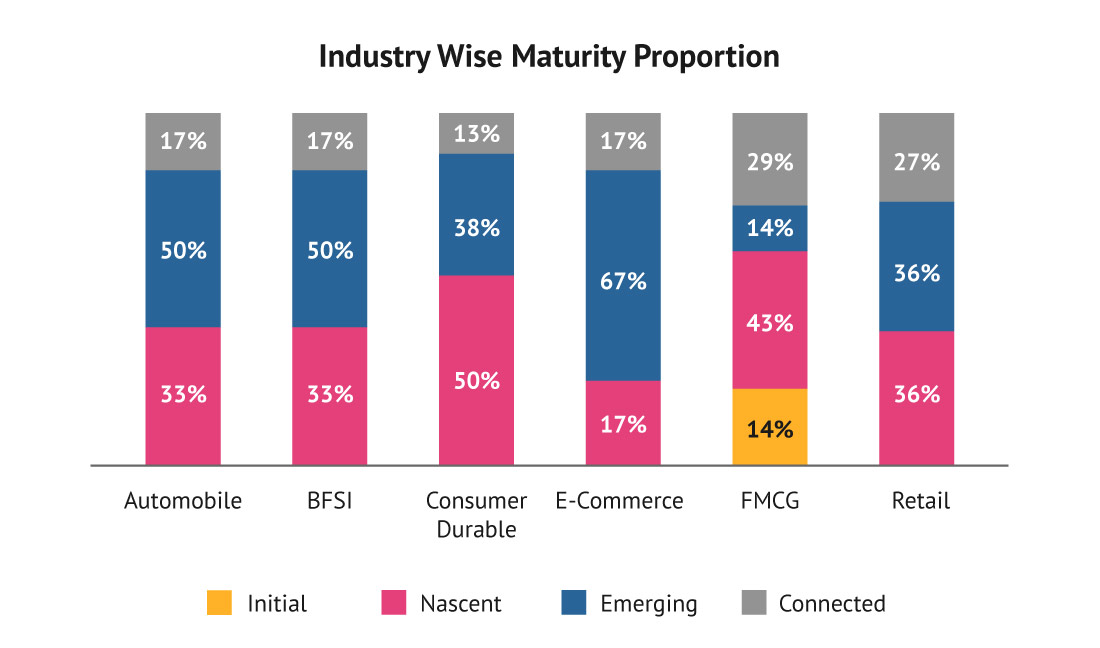

MarTech Maturity across Industries

The industry wise maturity had some interesting observations. Over 80% of the organizations were at level 3 or above among the E-commerce companies, which was among the early adopters of MarTech. BFSI was also a relatively early adopter of MarTech with over 50% of the organizations in level 3. The bigger players in BFSI started leveraging technology much earlier than most for a range of initiatives like disseminating information about products & services, customer education, customer service and so on.

FMCG was also an interesting sector with a lot of variation in the maturity. While close to 30% of the FMCG companies were at level 4, there were also over 55% between level 1 and level 2. Retail is another sector, which started a bit late, but a few leaders have shown the way in adopting MarTech.

-

Customer Maturity

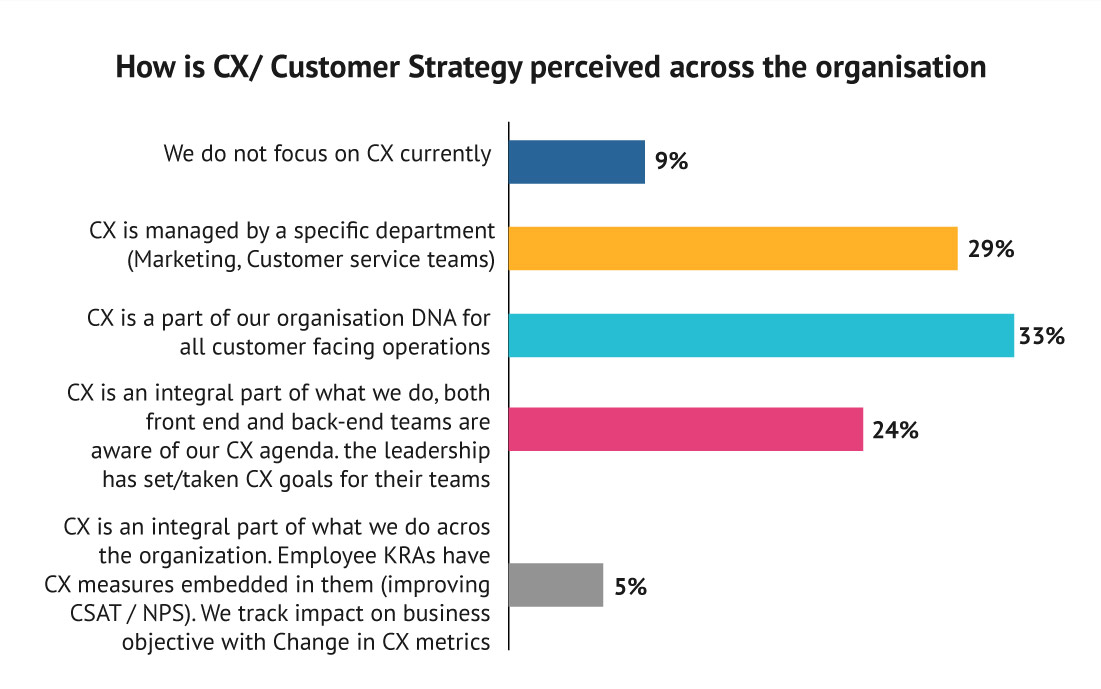

How is CX/Customer Strategy perceived across the organisation?

33% of the responses indicated that CX Strategies were being applied primarily for all customer facing operations. 29% of the responses also suggested that the responsibility of CX is being taken by a specific department within the organization. However, very few organizations are tracking CX metrics & their impact on business objectives meticulously.

-

Analytics Maturity

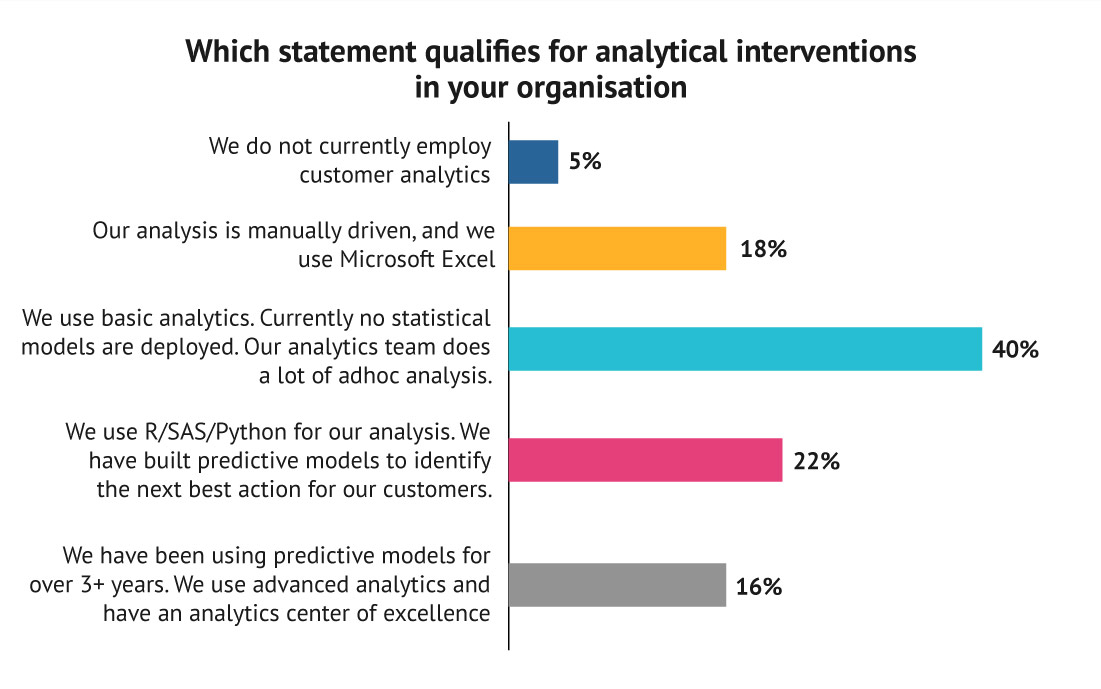

Which statement qualifies for analytical interventions in your organization?

It is observed that around 95% of the organizations are deploying some or the other form of customer analytics. However, 58% of the organizations are still using very basic analytics or Microsoft Excel on an ad-hoc basis instead of making use of advanced statistical and predictive models.

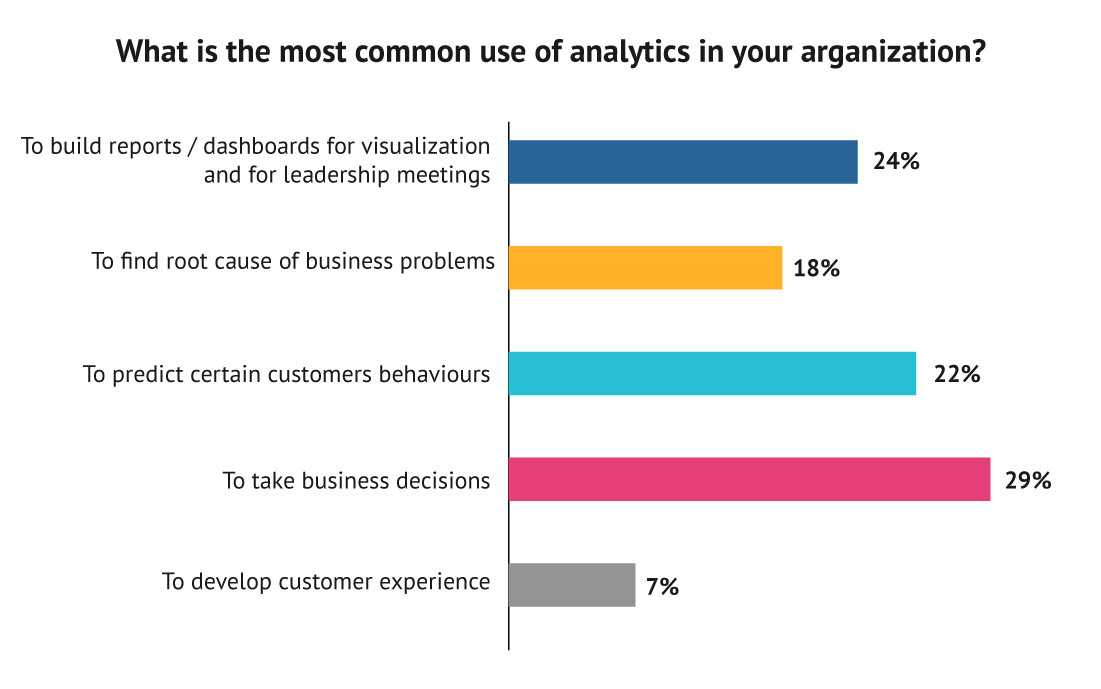

What is the most common use of analytics in your organization?

29% of the organizations have been using analytics to take important business decisions. Another favorable use case of analytics suggested by 22% of the respondents is to predict customer behavior. Only 7% of the organizations are making use of analytics to develop customer experience strategies.

-

Digital Maturity

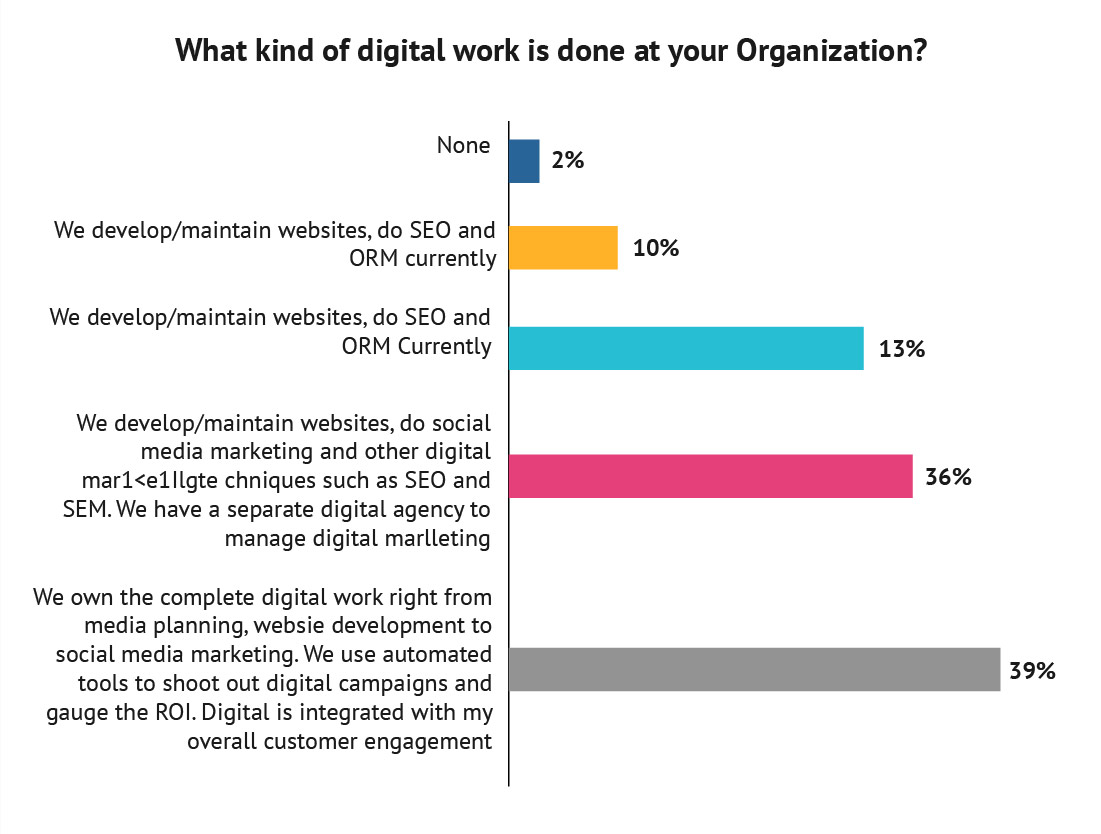

What kind of digital work is done at your organization?

The survey also revealed that a staggering majority of organizations are putting a great deal of effort into digital marketing. The responses were divided closely with regards to the entity handling the digital work. 36% of the organizations outsource their digital marketing to a separate digital agency, while 39% of the organizations seem to handle the end-to-end digital process by themselves.

Technology Maturity

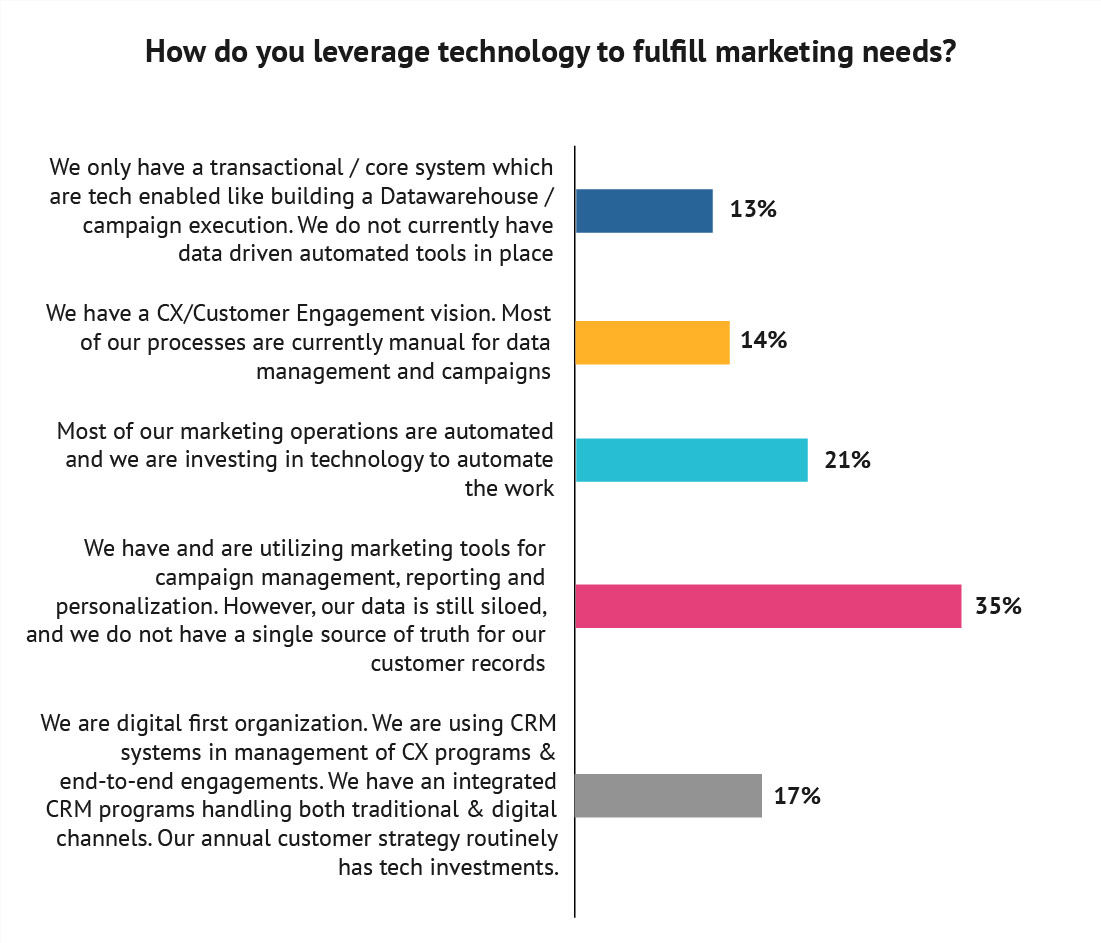

How do you leverage technology to fulfill marketing needs?

Around 35% of the respondents suggested that they leverage marketing technology tools for purposes such as campaign management, reporting and personalization. However, the data still sits in silos and there is no single source of truth for most. Around 27% of the respondents said that these operations are still not automated and most of the work is currently being done manually.

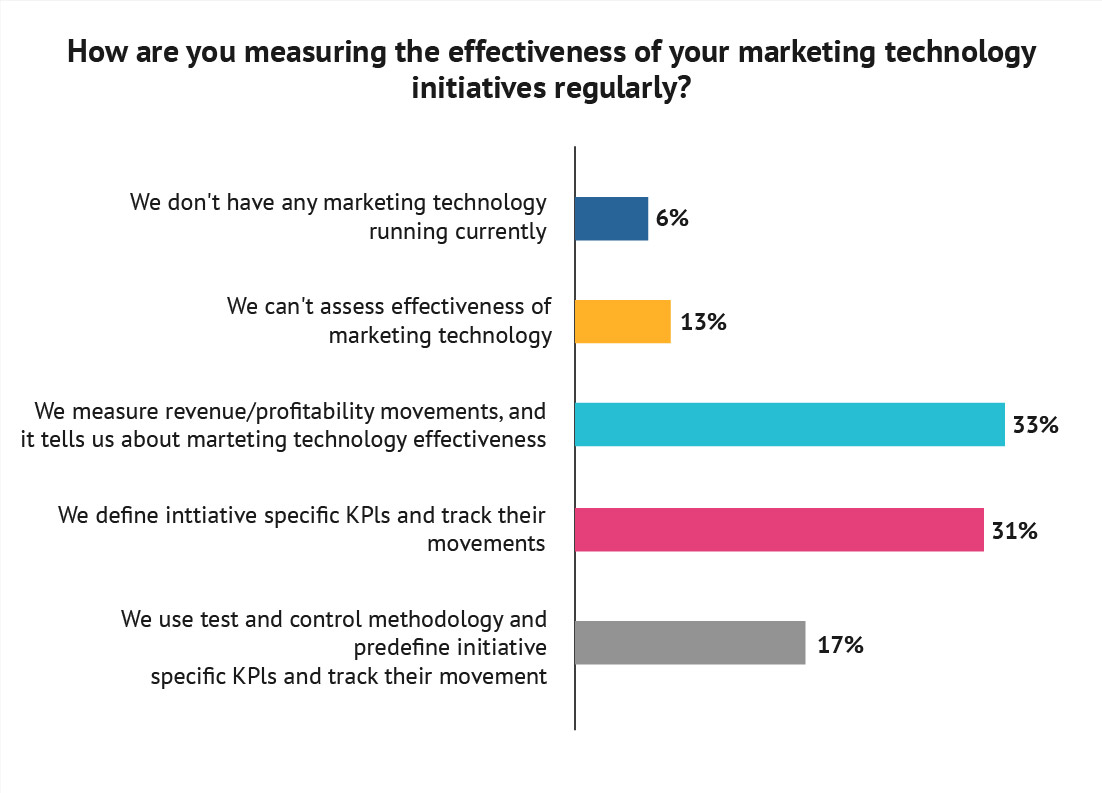

How are you measuring the effectiveness of your marketing technology initiatives regularly?

The most popular method of measuring effectiveness of marketing technology according to 33% of the responses is to assess revenue/profitability movements. 31% of the respondents have said they identify the initiative specific KPIs and track their movement.