Contents

-

MarTech Maturity India Research Findings

Research Objective

To understand the evolving business dynamics for the adoption of MarTech and assess the maturity level of various companies in leveraging MarTech to provide a connected customer experience.

Research Parameters

Time period: April and May 2021

Key Industries:

• Banking, Financial Services & Insurance (BFSI) • Automobile • FMCG • Consumer Durables • E-commerce • Retail

Respondents: 125+ CXOs and Senior Marketers from diverse industries in India

MarTech Maturity Research Findings

Overall MarTech Maturity

-

Forty percent of the organisations were at a nascent stage in the MarTech journey, corresponding to level 2. Another 32% were at level 3, where standards were being put in place and Centre of Excellence model was typically operational. These are good indicators reflecting the fact that many organisations in India have kick started their MarTech journey. Only 12% were just beginning their MarTech journey with limited knowledge of this space. 15% of the organisations were at a mature level 4 stage, which represents a “connected” organisation with clearly identified goals, roles & responsibilities, and governance protocols to achieve improved customer engagement. This number is expected to increase across industries in the coming years.

MarTech Maturity across Industries

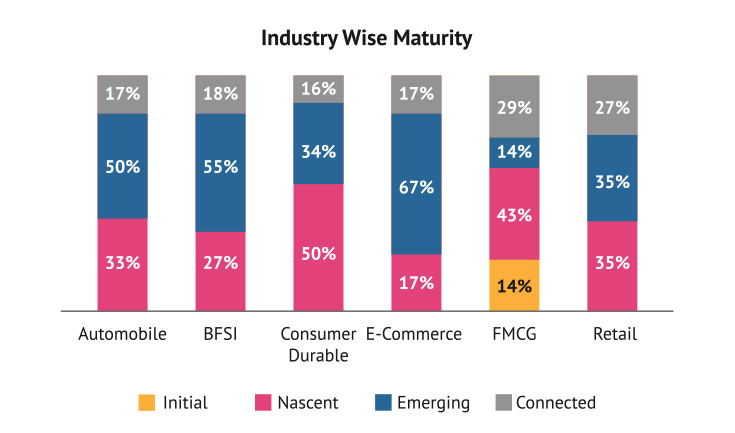

The industry wise maturity has some interesting observations. Over 80% of the organisations were at level 3 or above among the E-Commerce companies, which were among the early adopters of MarTech. BFSI is also a relatively early adopter of MarTech with over 50% of the organisations in level 3. The bigger players in BFSI started leveraging technology much earlier than most for a range of initiatives like disseminating information about products & services, customer education, customer service and so on.

FMCG was also an interesting sector with a lot of variation in the maturity. While close to 30% of the FMCG companies were at level 4, there were also over 50% companies between level 1 and level 2. Retail is another sector, which started a bit late, but a few leaders have shown the way in adopting MarTech.

-

Emerging Trends in the MarTech space

Top areas oranganizations want MarTech Vendors to focus on

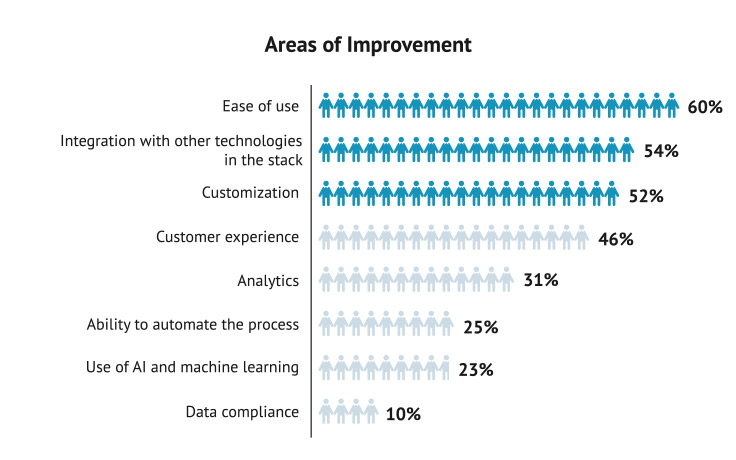

Three out of five respondents felt ease of use as an area of improvement. Products and platforms need to be simple to use and intuitive. Simplicity with essential features trumps a complex product with multiple features. This one change could go a long way in improving the adoption of MarTech and getting buy-in from business stakeholders.

54%, again a high number, felt that integration with other technologies in the stack could be improved. A common mistake made is to invest in a set of individual siloed tools that an organisation then tries to get to work together which invariably results in inefficiencies. The need for better integration is a pressing issue.

Customization to suit their specific needs, Customer Experience and Analytics were all highlighted by a significant number of respondents as areas of improvement. These are lessons for MarTech product vendors to keep in mind while designing products.

-

Top impediments in achieving business goals

Almost 70% felt the integration of Marketing and Technology solutions was a big impediment in achieving business goals. This is a common issue faced across industries. Traditionally, Marketing and IT tend to work in silos. With the increasing role of technology in marketing, there is realisation of the benefits of having a collaborative approach and the need to fix this gap fast.

66% felt that constructing use cases with a clear objective was a major impediment. Getting the people ready with the right training and upskilling was also highlighted by over half the respondents as a problem area. This is a reflection of the diverse skills required to make MarTech work. Marketers today need to be able to appreciate and understand multiple areas like database management, automation, predictive modelling, and testing.

-

Top emerging technologies that will have the largest positve impact on the company's marketing activites in the next 5 years

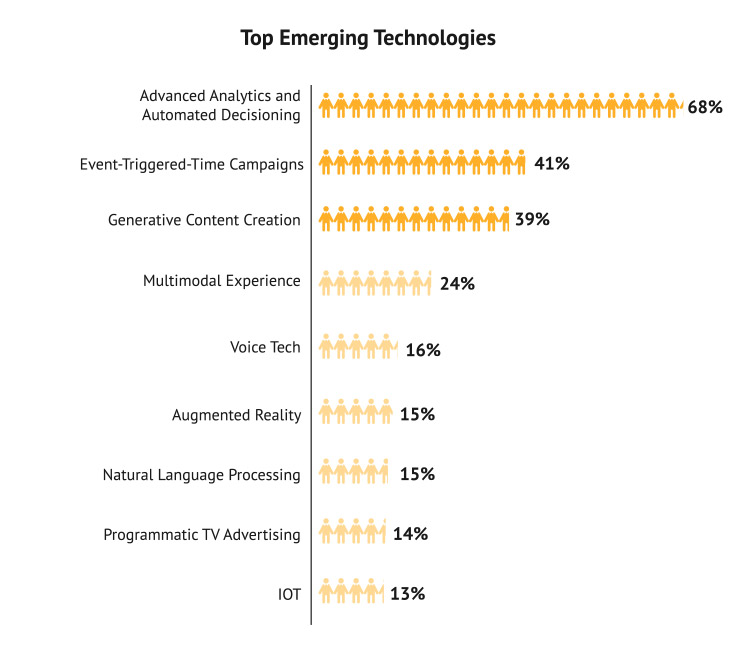

Advanced analytics & automated decisioning came out as the top emerging technology, picked up by 68% of the respondents. This was rated as the top pick by a big margin. That data can be the differentiator is not a story that needs to be sold anymore to marketers. With more and more marketers coming from a left brained background, this area has got a big boost across industries.

Event triggered campaigns was picked by 41% of the respondents. This is also the realization of the need to reduce the time lag between the creation of data to acting on it. More and more companies are gearing themselves for real-time engagement. This number is expected to further increase in the coming years.

-

How do you expect spending on MarTech in your oraganization to evolve over the next 5 years?

Overwhelming majority of organisations felt the MarTech spending will increase over the next five years. This was true across the board, from very big to small organisations. This is a welcome sign that despite being in the middle of a pandemic, most marketers are optimistic about increasing their spends in the future. This is a sign of the growing importance of MarTech as a key differentiator in driving a connected customer experience.