Contents

-

Redefining Customer Experience through Experiential Marketing!

The consumer of today wants to experience a product before they commit to it.

• How will a T-shirt on them look like in an outdoor setting? • How will the sofa look in their living room? Experiential marketing through Augmented Reality, Virtual Reality and Mixed Reality is redefining customer experience. Augmented Reality (AR) – the ability to overlay and share physical objects, spaces and images on a user’s view of the real world– is revolutionizing the customer experience.

Through new mobile technology, AR has emerged as an innovative tool that allows brands an almost unlimited opportunity to interact three-dimensionally with consumers on their mobile devices. Augmented reality customer experience is a new digital experience that transforms the customer journey into an immersive visual interactive experience. Increased used of AR & VR has enabled the customers to experience three-dimensional outlay of their desired product at their convenience.

-

Redefining Customer Experience through Experiential Marketing!

For example:

A leading international retail brand allows their customer to see the apparel in Virtual Reality through a ramp-walk on their mobile app. Adaption to three dimensional visualization has increased especially in the last one year while the trial rooms were shut and people wanted to visualize the product before buying.

Many BFSI entities have shifted their entire onboarding to digital modes where the verifications are done through video calls.

-

Case Study 3

Brand/Company Name: Max Life Insurance Category/Industry: Insurance Title: Boosting E-Commerce Sales by 11% through Direct Channels Agency: Netcore Context/Background

This case study highlights how a leading player in the insurance landscape, Max Life, deployed and benefited from Netcore’s intelligent customer engagement platform. The company is a subsidiary of the publicly listed Max Financial Services Ltd. and is the largest non-bank private-sector life insurer in India.

Unifying and utilizing relevant customer data, preventing interested buyers from dropping-off, and building meaningful 1:1 customer relationships are some of the major challenges that insurance companies – looking to embrace digital transformation successfully – encounter.

Problem Statement

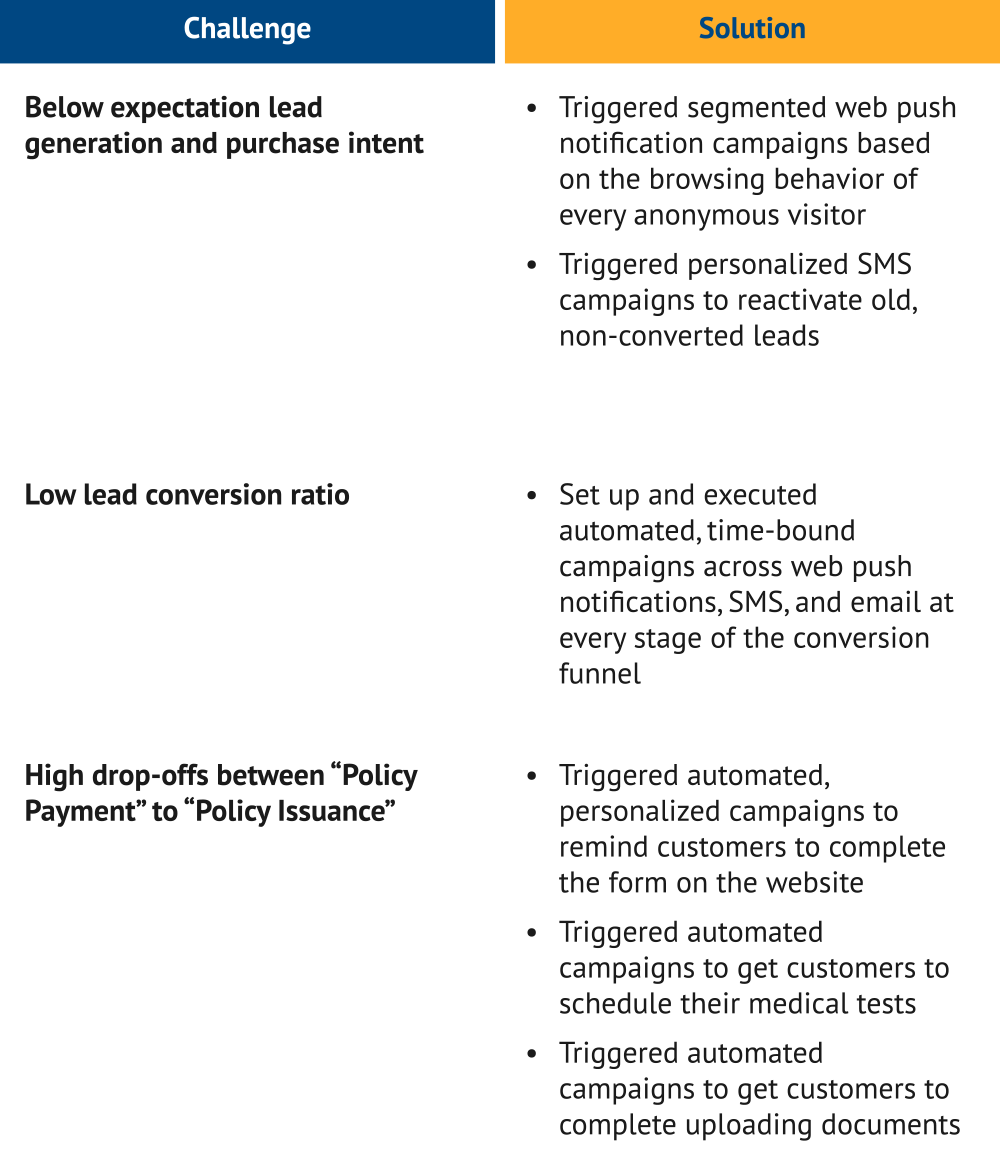

Max Life was faced with the following challenges:

1. Below expectation lead generation and purchase intent: Owing to their in-house digital marketing team’s inability to engage with and convert website visitors into identified leads and allowing previously identified leads to go dormant, the leads generated were below the expected targets 2. Low lead conversion ratio: The absence of an end-to-end customer acquisition and engagement martech solution meant that there was significant churn while moving through the “Lead” to “Policy Payment” stages of the conversion funnel 3. High drop-offs between “Policy Payment” to “Policy Issuance”: The complicated proposal form-filling process and scheduling of medical tests resulted in incomplete policy-buying journeys -

Objective/Goal

Max Life wanted to deploy an easy-to-implement martech solution that would help them address the above challenges while orchestrating intelligent customer journeys – through the most impactful channels of engagement - on their website. These journeys needed to nudge website visitors along the path of conversion composed of the following stages:

1. Lead Generation: Capturing the visitor’s contact details 2. E-Quote Generation: Calculating the term insurance premium and showcasing the best possible plan 3. Policy Payment: Completing the purchase of the most relevant plan 4. Proposal Form-Filling: Completing the Proposal Form 5. Medical Test Scheduling: Setting up the medical test at a date and time of the customer’s convenience 6. Documentation Uploading: Uploading all relevant documentation digitally on the website 7. Policy Issuance: Sharing of the policy documents to the customer over email

-

Solutions

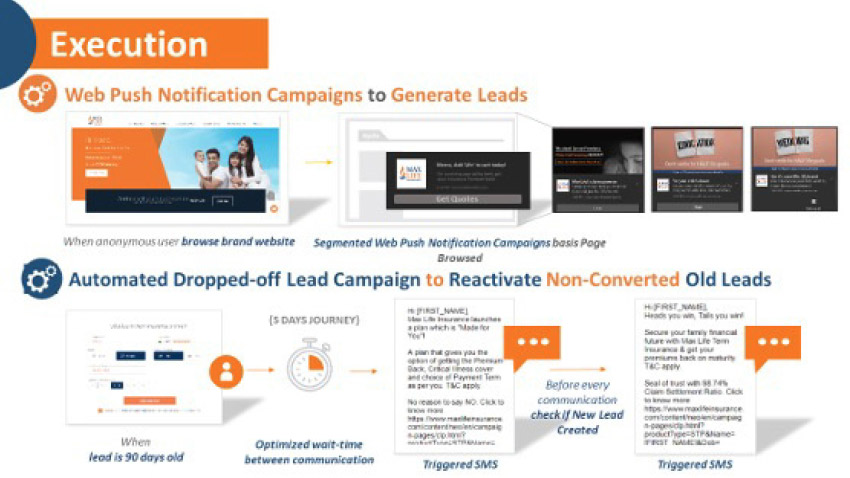

Execution

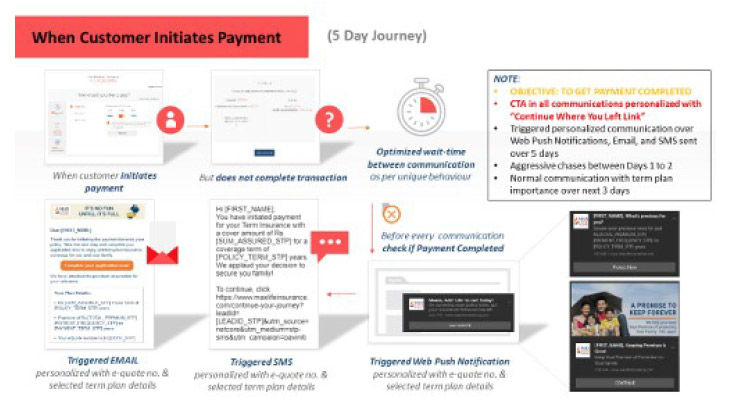

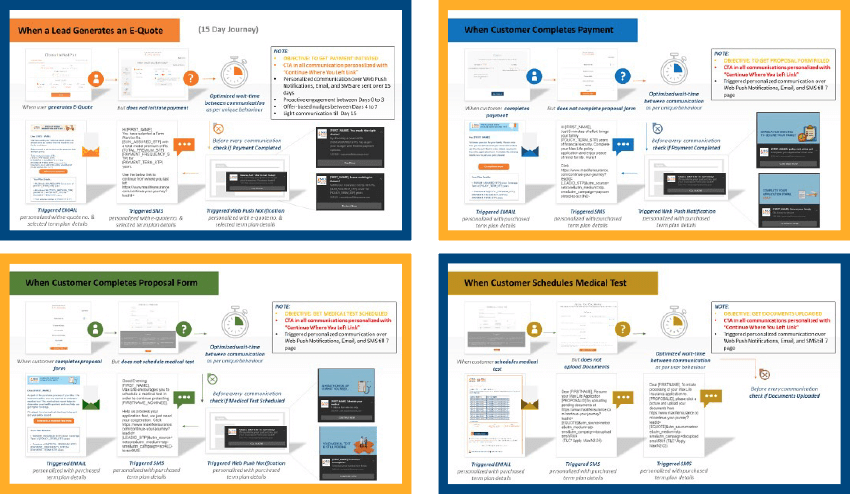

After A/B testing these cross-channel automated campaigns – to address each of Max Life’s challenges – they were deployed to a larger audience. The following are illustrations of the complex journeys that were designed and implemented:

-

Automated cross-channel customer engagement campaigns to reduce drop-offs at every stage of the conversion funnel:

The Result

1. Last-click sale contribution through direct channels for their E-Commerce business increased from 1% to 12% in less than 6 months 2. It generated 6% of the total leads on Max Life’s website per month 3. Automated engagement campaigns to reactivate old leads generated ~7,000 new leads with 9% CTRs and 2% Payment Conversion Rate, creating additional business of INR 25 lakh per month 4. Web Push Notifications contributed to 35% of payment conversions